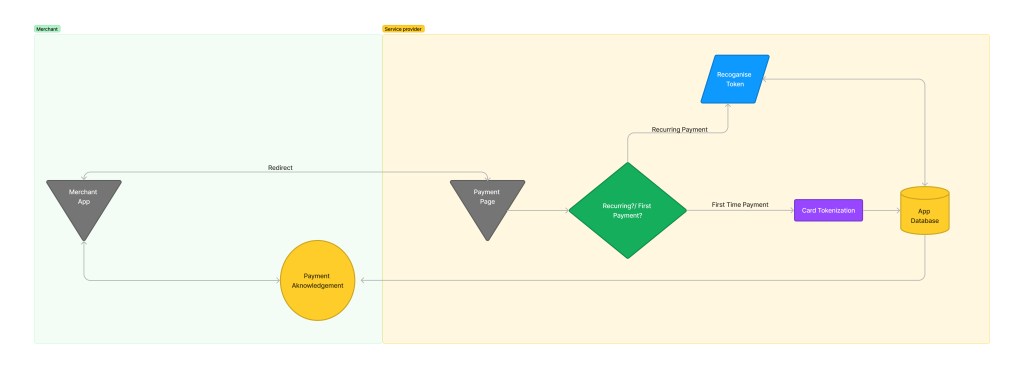

PCI DSS Merchants

In the world of PCI DSS, merchants are the ones who receive payment card information from their valued customers. While their main priority is to sell goods and services, we can also view them as the “frontline sellers” of their retail shops. Just think of the bustling clothing stores, busy manufacturing companies, and flashy car showrooms.

PCI DSS Service Providers

A service provider is responsible for managing payment card data on behalf of merchants through various means like processing, storing or transmitting card data. These providers can offer services in the areas of payment processing, web hosting, managed security, and other tasks that involve the protection of cardholder information.

Key Differences: Service providers vs Merchants

- Focus: Merchants are laser-focused on their core business operations, which revolve around selling goods and services. Meanwhile, service providers are experts in providing specialized services for payment card processing and data security.

- Card Handling: When it comes to handling cardholder data, it’s a regular part of merchants’ day-to-day activities as they process transactions. Service providers, on the other hand, may have access to this data as they carry out their tasks, and they may also store, process, or transmit it on behalf of merchants.

- Compliance Requirements: To guarantee the protection of cardholder data within their systems, merchants must adhere to specific PCI DSS requirements. On the other hand, service providers bear a greater responsibility as they are involved in various aspects of payment card data management. Therefore, they face a rigorous process of scrutiny and verification to ensure that their services do not pose a threat to the security of cardholder data.

Published by: Ankit K J

Leave a comment