A PCI DSS Series

Welcome to a series where we deep dive into the standard of controls that ensure the safety of your credit card data.

PCI DSS

PCI DSS, which stands for Payment Card Industry Data Security Standard, is a set of security standards designed to ensure the security of all organizations dealing with credit card information.

HISTORY

The PCI DSS Standard was formulated in 2004 with the advent of the Payment Card Industry Security Standards Council (PCI SSC), which consists of major credit card companies such as Visa, MasterCard, American Express, Discover, and JCB.

Prior to PCI DSS, each major credit card company enforced their own major security programs, to address interoperability, this ultimately led to formation of PCI SSC. Combined efforts from such major organizations resulted in the release of PCI DSS v1.0. Later iterations of the standard included the release of the latest standard, v4.0.

Why PCI DSS?

It’s crucial for organizations to adhere to PCI DSS in order to effectively safeguard payment card data and minimize the risk of cyberattacks. In essence, complying with this data security standard entails implementing a strong set of protective measures, such as encryption, access controls, ongoing monitoring, and vulnerability management. To ensure compliance, qualified security assessors typically conduct assessments and audits to validate an organization’s adherence to these crucial protocols.

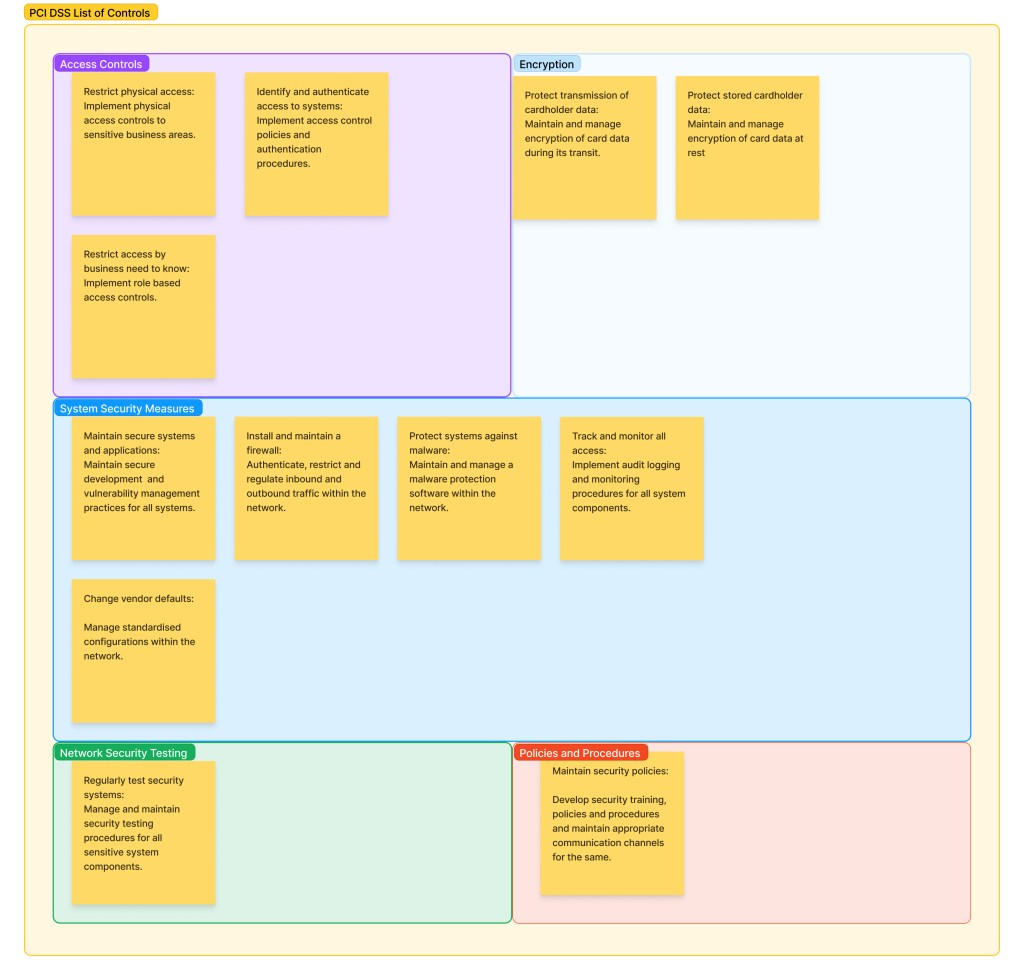

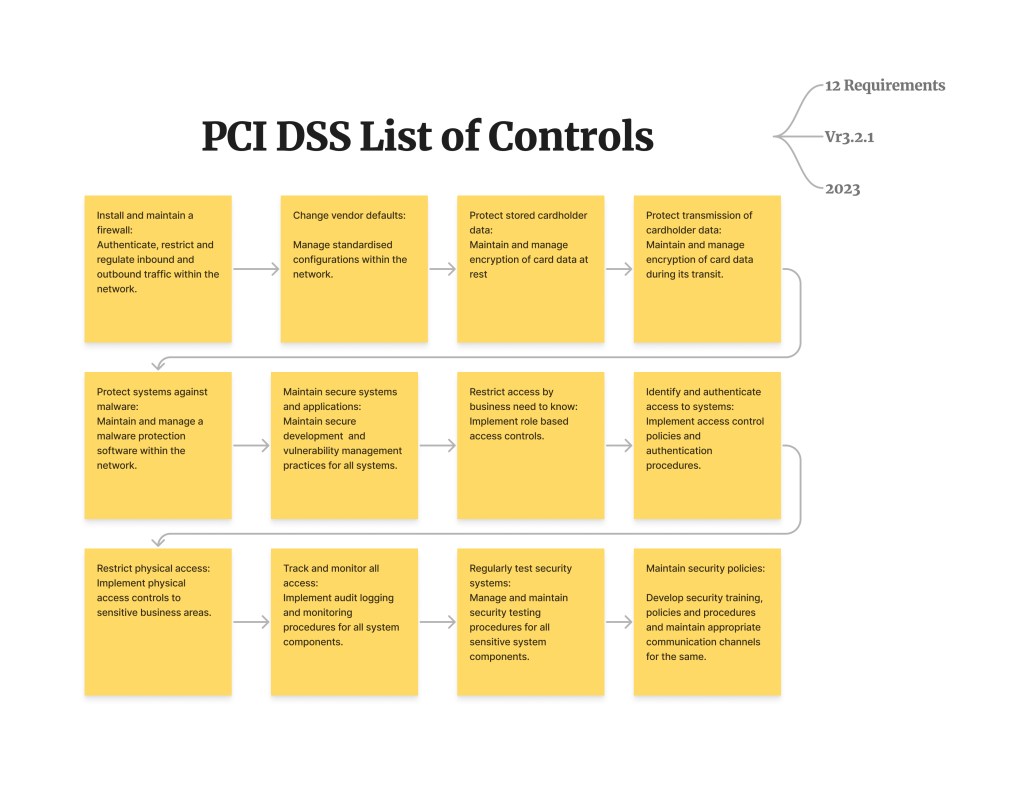

PCI DSS Controls

The Payment Card Industry Data Security Standard (PCI DSS) serves as a comprehensive guide for safeguarding credit card transactions and preserving cardholder information. This essential standard encompasses 12 key requirements, classified into six fundamental control objectives. These requirements are applicable as per the scope of the assessment determined by the Qualified Security Assessor (QSA), who is responsible for attestation of PCI DSS certifications. The scope of the assessment for any PCI DSS attestation is determined on the basis of the storage, transmission and processing (of cardholder data) capabilities of the organization and the number of card transactions per year.

Published by: Ankit K J

Leave a comment